For 401(k) and IRA Millionaires

Don’t Let Taxes

Drain Your Retirement

If most of your savings are in a 401(k) or IRA, you could quietly lose 30-40% to taxes. We help you keep more of what you’ve built with a plan that turns your savings into tax-efficient income.

You’ve Saved For Decades. Now What?

You’ve done the hard part and built up a retirement nest egg of $1 million (or more).

But now you’re facing questions no one warned you about…

Most retirement mistakes happen before retirement even starts. And that’s why having a plan now (before you leave work) is so important.

A Simple Plan to Retire with Confidence

We help people with $1M+ in pre-tax retirement accounts (like 401(k)s and IRAs) build a plan they can feel good about.

We focus on three areas that make the biggest impact.

-

💸 Taxes

Cut the long-term tax hit from your 401(k) or IRA withdrawals.

-

💰 Income

Turn your savings into steady, reliable income you can count on.

-

🛡️ Risk

Avoid surprises like Medicare penalties, Social Security mistakes, or estate planning gaps.

No Plan? Here’s What That Could Cost You.

Without a clear retirement strategy, you might:

💸 Pay more in taxes than you needed to

💊 Trigger higher Medicare premiums

⏰ Take Social Security too early (or too late)

⚠️ Leave your spouse or kids with a financial mess

But with the right plan, you can avoid surprises and make sure your money goes where you want it to.

Retirement Numbers You Can’t Afford to Miss

One simple guide to help you lower taxes and keep more of your money in retirement.

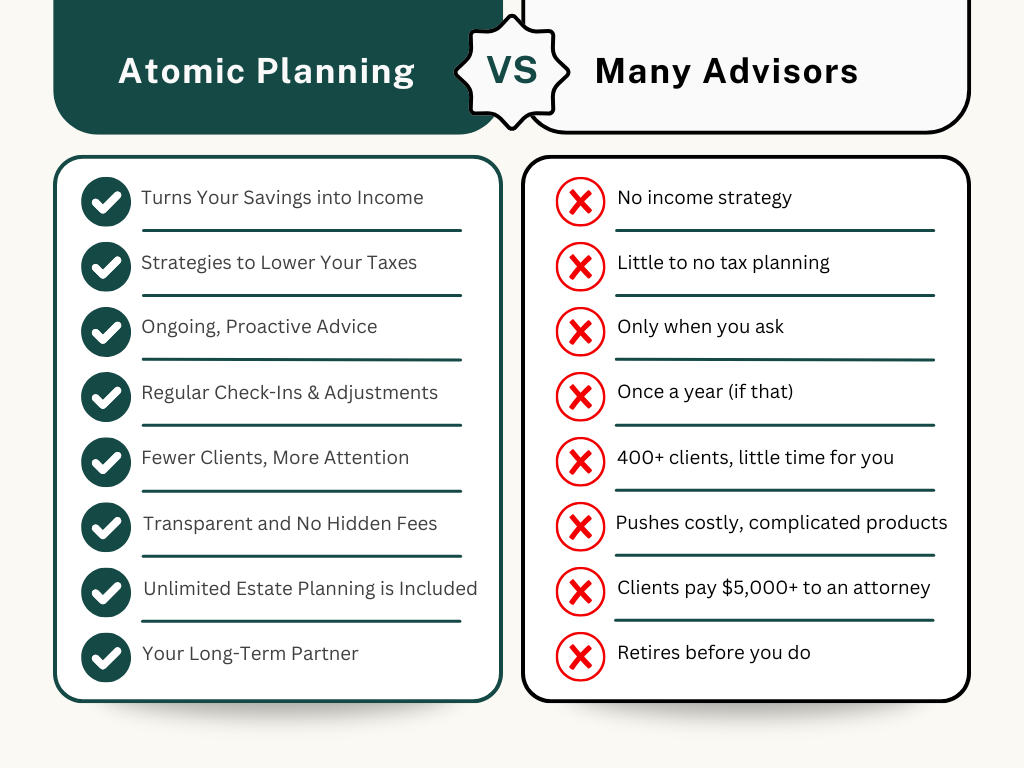

Why People Choose Atomic Planning

Not all financial planners take a proactive, tax-smart approach to retirement planning.

Still Have Questions? We’ve Got Answers.

Here are some of the most common questions we hear from people planning for retirement.

-

Always. We’re fiduciaries, which means we’re legally and ethically required to act in your best interest. That’s how financial advice should work.

-

Most families we work with pay a 1.00% annual fee, billed monthly, on the assets we manage.

And that fee automatically goes down as your accounts grow.

No hidden fees. No commissions. No product sales.

-

They can but it depends on your situation. We’ve helped some clients project six-figure tax savings by spreading out conversions over time. It’s all about timing and having a smart strategy.

-

Yes. We’ve written about one couple’s plan here.

-

We check in quarterly and meet twice a year (once in the spring and once in the fall) to review your plan and make sure everything stays on track.

In between, you’ll get a short weekly newsletter with planning tips, timely updates, and reminders to help you stay informed without the overwhelm.

And if something comes up, just reach out. We’re quick to respond, usually the same day.

-

Your investments are held securely at Altruist, a trusted custodian that works with independent advisors like us. They handle the behind-the-scenes work (like asset storage, trading, and reporting) so we can focus on your planning and investment strategy. LEARN MORE

-

Absolutely. We’re happy to coordinate with your CPA or estate attorney to make sure your financial, tax, and legal strategies all work together. Don’t have one? We can connect you with trusted professionals from our network. You’ll also get access to a digital estate planning tool (included at no extra cost) that lets you create and manage state-optimized legal documents like:

Revocable Trust & Pourover Will

Last Will & Testament

Financial Power of Attorney

Advance Health Care Directive

Guardianship Nominations

-

Not at all. We work virtually with retirement savers across the country. Wherever you’re located, we’re ready to help. SCHEDULE HERE.

Is Our Planning Approach Right for You?

Find out in about 60 seconds👇